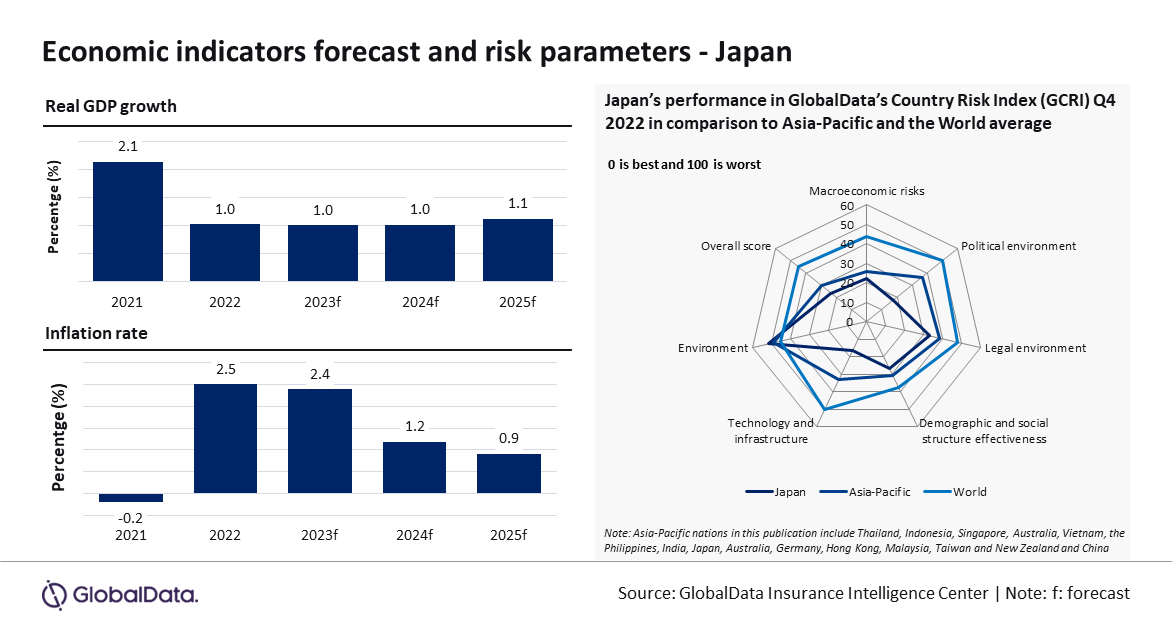

Despite potential challenges posed by high prices and lower external demand, Japan’s economy is poised to experience a moderate recovery following its reopening in October 2022. Against this backdrop, the Japanese economy will maintain its growth momentum with a projected expansion of 1% in 2023, the same as the previous year, forecasts GlobalData, a leading data and analytics company.

GlobalData’s latest PESTLE Insights report, “Macroeconomic Outlook Report: Japan reveals that the country experienced 0.4% expansion in Q1 2023 on a quarterly basis. This growth was primarily driven by a 0.6% increase in private consumption and a 0.9% upswing in business investments.

However, the economy still faces challenges due to high price levels, as the inflation rate exceeded 3% in the first four months of 2023, surpassing the Bank of Japan’s target of 2%. Particularly, food prices remain stubbornly high, reaching an 8.4% increase in April 2023, the highest since August 1976. These inflationary pressures are expected to impact domestic demand, leading to a projected slowdown in real household consumption expenditure growth from 2.1% in 2022 to 0.9% in 2023.

Puja Tiwari, Economic Research Analyst at GlobalData, comments: “One of the primary impacts of the rising energy prices and the widening interest rate disparity between Japan and the US is the sharp depreciation of the Japanese Yen against US dollar. The yen depreciated by 19.7% over last year to JPY131.4 per $ in 2022 and is projected to depreciate further to JPY132.7 per $ in 2023. The depreciation has caused the import prices of energy, food, and raw materials to rise thereby burdening household and businesses.”

Sector-wise, financial intermediation, real estate and business activities contributed 25.0% towards GVA, followed by mining, manufacturing, and utilities activities (24.1%), and wholesale, retail, and hotels utilities (13.8%) in 2022, according to GlobalData. The three sectors are forecast to grow by 2.6%, 4.4%, and 0.4%, respectively, in 2023.

The reopening of Japan’s borders is anticipated to have a substantial impact on the country’s tourism industry, serving as a crucial driver of economic growth amidst a decline in external demand. GlobalData’s Travel and Tourism Database forecasts a noteworthy surge in international arrivals, with numbers projected to increase from 1.3 million in 2022 to an impressive 18.6 million in 2023.

To tame the rising price pressure, the Japanese government has approved an economic package of around JPY29 trillion ($200 billion) in October 2022. The country is expected to finance the lion’s share of the stimulus through new borrowings, mainly by issuing deficit-covering bonds. Japan’s general government debt was at 261.3% of GDP in 2022, one of the highest in the world, and additional debt is expected to contribute to the country’s already substantial debt load.

Japan is categorized as a low-risk nation and ranks 13th out of 153 nations in GlobalData Country Risk Index (GCRI Q4 2022). The country’s risk score is lower in various parameters, including macroeconomic, political, legal, demographic, and social structure as well as technology and infrastructure, when compared to the average of Asia-Pacific nations in Q4 2022.

Tiwari concludes: “While Japan’s stimulus package aims to diversify the energy sources and improve energy security, the country’s track record as the largest lender for fossil fuel projects in the past decade raises concerns. Moreover, hosting meetings that promote the expansion of fossil fuel-based technologies poses a challenge to the transition towards green energy.”

Also read: Countries with the highest average tourist visa fees