Trading stocks and shares is a popular activity for people in Britain and around the world. In the UK around a third of the adult population own stocks, and it is even higher in America where 58% of adults own stocks. In Australia almost 9 million people own stocks, and around half of Singaporeans invest as well.

Members of the public, funds, and companies interact with the stock market in many different ways. Whether they are simply buying and selling stocks through a broker or speculating on their price via derivatives, such as CFDs.

One of the reasons so many people have an interest in the stock market is because of the potential opportunities that come from trading. As of May 2021, the global stock market is worth around $95 trillion1, made up of investors of all shapes and sizes.

An initial public offering (IPO) is the first time a company lists its shares on a stock exchange. The process is commonly referred to as ‘taking a company public’, as it’s the first time a company offers shares to the public.

A possible benefit of going public for a large company is that selling shares can potentially raise the value of the company and increase its available capital. And as long as it is attractive to investors, a company can profit if the share price increases after the IPO.

Over the years countless companies have gone public, with varying success. But which have been the biggest? We’ve studied the largest IPO deals of all time across the globe to provide a definitive list. We’ve also looked at the most profitable IPOs for investors in recent years, as well as how long it took the biggest companies in the world to go public.

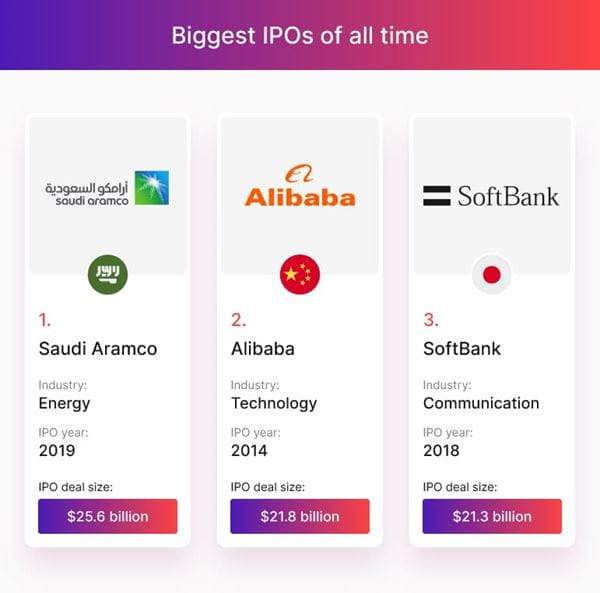

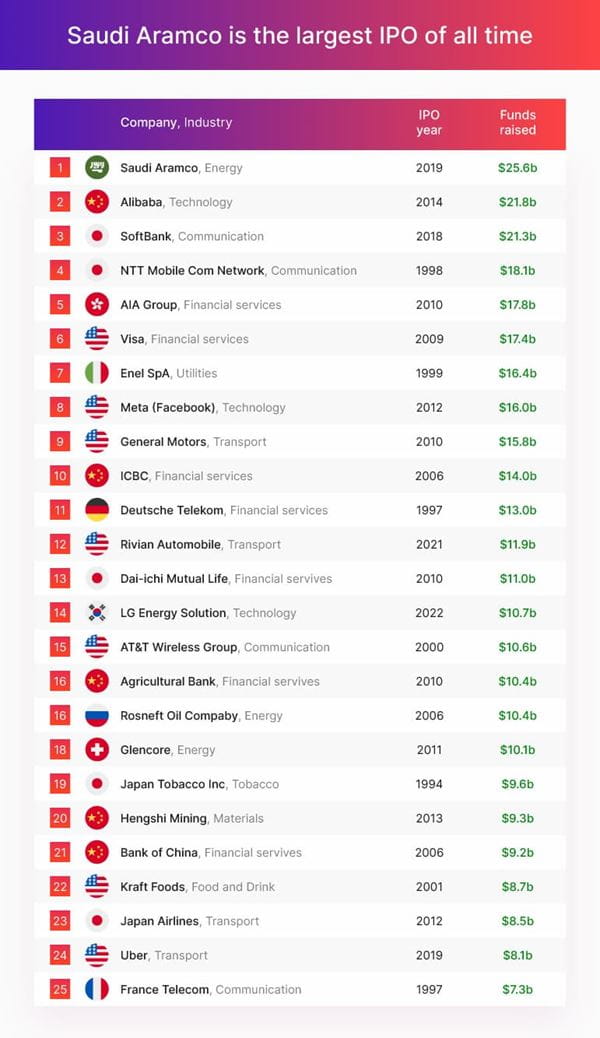

Biggest IPOs of all time

1. Saudi Aramco

IPO deal size: $25.6 billion

The largest IPO of all time occurred in 2019 when Saudi Aramco oil company was floated. The offering generated over $25 billion in investment, beating the previous record holder by almost $4 billion. Aramco’s public market cap is almost $2 trillion – as of March 2023 – making it the third most valuable company in the world after technology giants Apple and Microsoft.

Based in Dhahran, Aramco is the biggest daily oil producer in the world with more than 270 billion barrels in crude oil reserves and has the sixth-highest revenue of any company, reporting over $400 billion2.

2. Alibaba

IPO deal size: US $21.8 billion

Alibaba is a Chinese technology company founded by Jack Ma in 1999 which has gone on to become one of the most valuable companies in the world, it made over $100 billion in revenue in 20223. Its IPO generated almost $22 billion when it was floated on the New York Stock Exchange in 2014, a record for an IPO at the time.

3. SoftBank

IPO deal size: US $21.3 billion

The SoftBank Group is a Japanese holding company which has interests in many different industries, including owning almost 24% of Alibaba. The SoftBank Corporation is an affiliate business that is the third-largest wireless carrier in Japan, and it was this wing of SoftBank which had the third-largest IPO in history in 2018. The offering made $21.3 billion, just $500 million less than Alibaba four years earlier.

Recent IPO success

Which companies stock price has risen the most since their IPO?

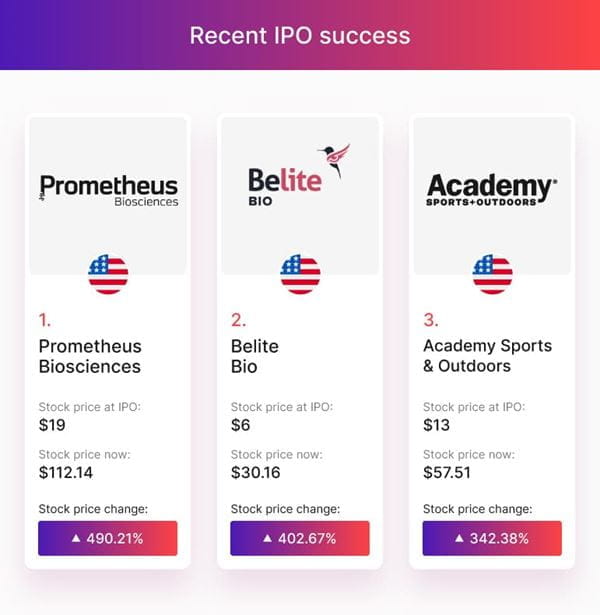

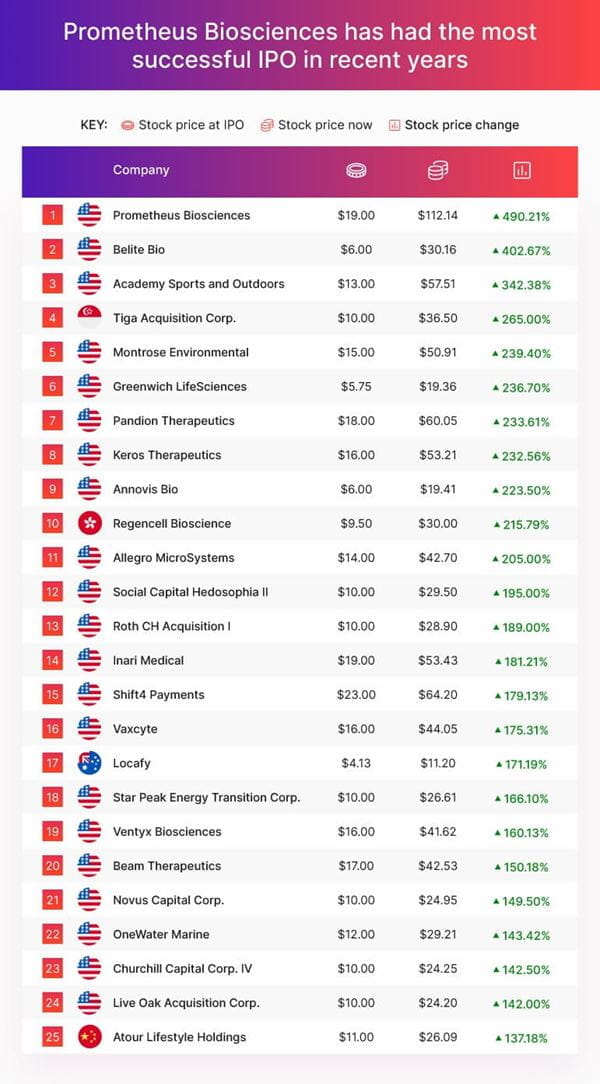

1. Prometheus Biosciences

Stock price at IPO – $19

Stock price now – $112.14

Stock price change – 490.21%

Prometheus Biosciences has had the most successful IPO in recent years, the pharmaceutical company had an IPO in March 2021. When it was initially floated the share price was $19 but has since risen to over $112 – meaning that investing $1,000 in the IPO would be worth $5,902 today.

2. Belite Bio

Stock price at IPO – $6

Stock price now – $30.16

Stock price change – 402.67%

Another stock that’s risen over 400% since its IPO is Belite Bio, which is also a pharmaceutical company. This San Diego-based company was founded in 2016 and went public six years later in April 2022. If you had invested $1,000 in the Belite Bio IPO you’d now have $5,027 worth of stock.

3. Academy Sports and Outdoors

Stock price at IPO – $13

Stock price now – $57.51

Stock price change – 342.38%

Academy is an American sporting goods company which had the third-highest increase in the stock price of any company that has gone public in recent years. The share price rose by almost 350% since the company was floated in October 2020. This means that a return of $4,424 could have been made from a $1,000 investment in this IPO.

Quickest companies to go public

One of the most significant moments in the life of a company is when it announces its IPO. In order to reach this point, the business will have had to perform well and offer potential investors a promising return on their investment.

These are the companies that have sprinted from being founded as privately held companies to floating their stock for public purchase, completing the process in three years or less.

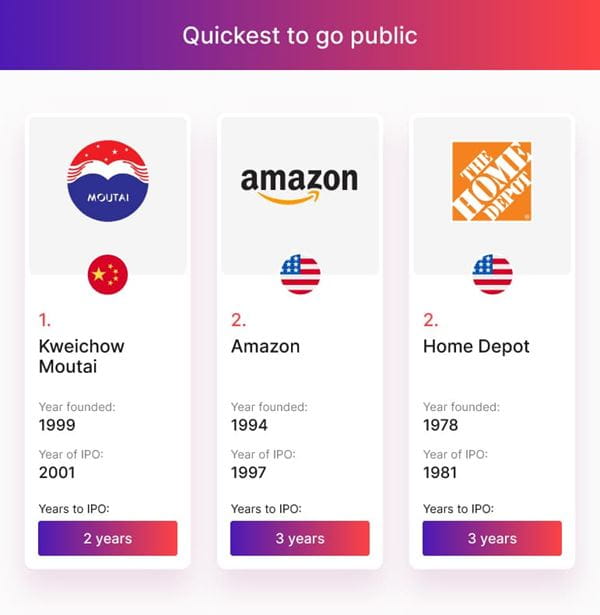

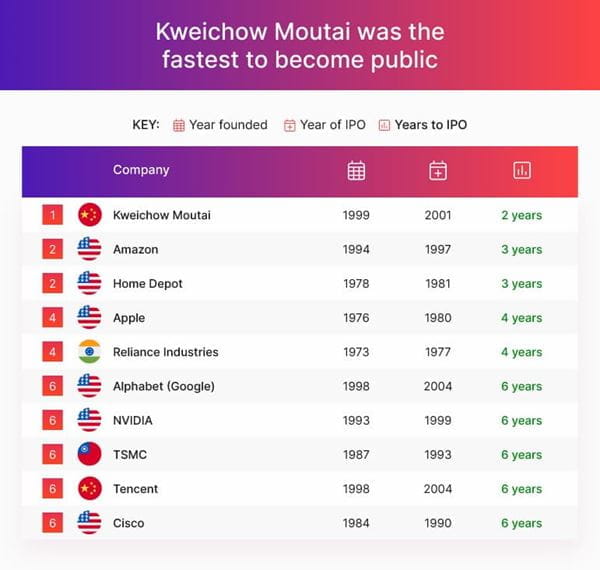

1. Kweichow Moutai

Year Founded – 1999

Year of IPO – 2001

Years to IPO – 2

Of the 25 largest companies by market cap, Kweichow Moutai was the fastest to become public. The Chinese government part owns this company, which makes an alcoholic spirit and is the largest beverage company in the world. In 2021 its revenue was just over $109 billion according to Reuters4.

2. Amazon

Year Founded – 1994

Year of IPO – 1997

Years to IPO – 3

Amazon owner Jeff Bezos is one of the richest men in the world based on the success of the online retail giant, Amazon. The company has thrived as the internet boom of the 21st century coincided with its operation growing across the globe. Amazon had an annual revenue of just under $514 billion in 20225.

3. Home Depot

Year Founded – 1978

Year of IPO – 1981

Years to IPO – 3

Another company that took just three years to become public after it was founded is the hardware and living store, Home Depot. The American retail giant made an annual revenue of over $151 billion in 20226.

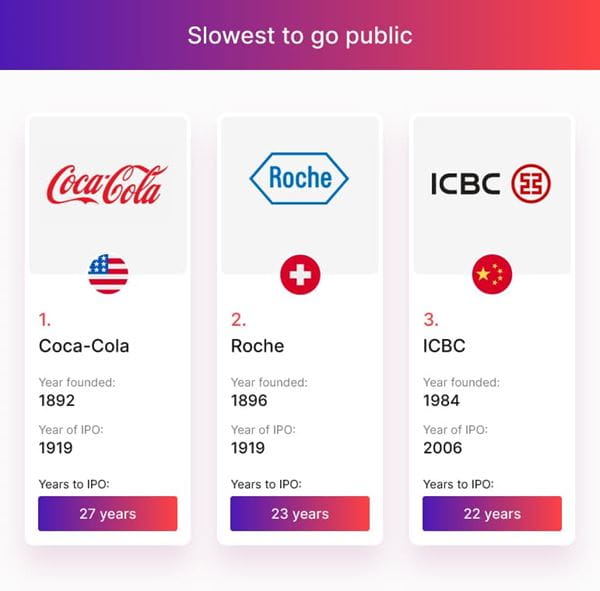

Slowest companies to go public

These are the companies that have sauntered from being founded to floating their stock for public purchase, completing the process in twenty years or more.

1. Coca-Cola

Year Founded – 1892

Year of IPO – 1919

Years to IPO – 27

On the other hand, Coca-Cola took almost 30 years to become public after it was founded in 1892. Coca-Cola was one of just four companies in the 25 largest to take more than 20 years to become public, another was its big rival Pepsi.

2. Roche

Year Founded – 1896

Year of IPO – 1919

Years to IPO – 23

Roche is a Swiss pharmaceutical company that is the leading provider of most cancer treatments globally and is the fifth-largest pharmaceutical company in the world. Roche became public in 1919 (the same year as Coca-Cola), however, the Swiss giant were founded six years later than the drinks firm.

3. ICBC

Year Founded – 1984

Year of IPO – 2006

Years to IPO – 22

ICBC stands for the Industrial and Commercial Bank of China, which became a publicly-listed company in 2006. It is state-owned and controlled despite it being public, and this titan of Chinese finance was the largest bank in the world in 2017 and 2018.

Also read: Investors hoping Xi and Macron secure better business ties between China and EU