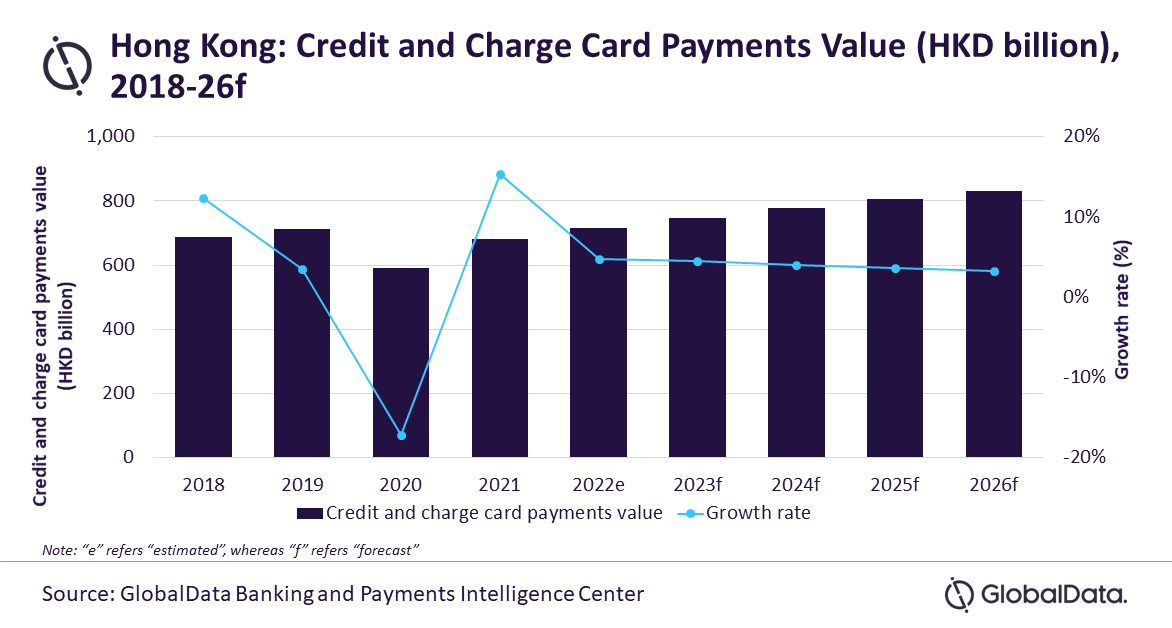

The Hong Kong credit and charge card payments market is set to grow at a compound annual growth rate (CAGR) of 3.9% between 2022–2026 to reach HKD831.9 billion ($106.7 billion) in 2026, driven by a significant shift in consumer preferences towards non-cash payment methods and recovery in consumer spending, forecasts GlobalData, a leading data and analytics company.

GlobalData’s Payment Cards Analytics reveals that credit and charge card payments value declined by 17.1% in Hong Kong in 2020, due to a decline in consumer spending during the pandemic. However, the market registered a strong 15.4% growth in 2021, supported by economic recovery and government initiatives. The credit and charge card payment value is expected to register a 4.6% growth in 2023.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Credit and charge cards are the most preferred payment cards in Hong Kong, accounting for 71% of total card payments by value in 2022. Government initiatives and opening of businesses have all increased consumer spending in Hong Kong, thereby benefitting its credit and charge card market.”

Availability of value-added benefits on credit cards such as reward points, discounts, and cashback, and limited use of domestic EPS debit cards are key reasons for high usage of credit cards in Hong Kong. EPS debit cards can only be used within Hong Kong’s border and for offline payments.

Sharma continues: “The credit and charge market in Hong Kong is mature with card penetration of 2.7 cards per individual and frequency of payments of 48.1, driven by its high financial literacy and well-developed payment infrastructure.”

The Hong Kong credit and charge card market still faces several challenges, including global geopolitical risks and inflation. The inflation rate in Hong Kong skyrocketed to 4.4% in September of 2022, compared to 1.2% in January 2022. To tackle inflation, the central bank increased its benchmark interest rate from 0.75% in March 2022, to 4.75% in December 2022.

Sharma concludes: “Rising interest rates will increase borrowing costs on credit cards, thereby discouraging credit card spending in Hong Kong. The ongoing Russia-Ukraine crisis and rising energy prices resulted in economic uncertainty across the world. These factors are weakening consumer confidence about their financial situation and could affect overall spending.”