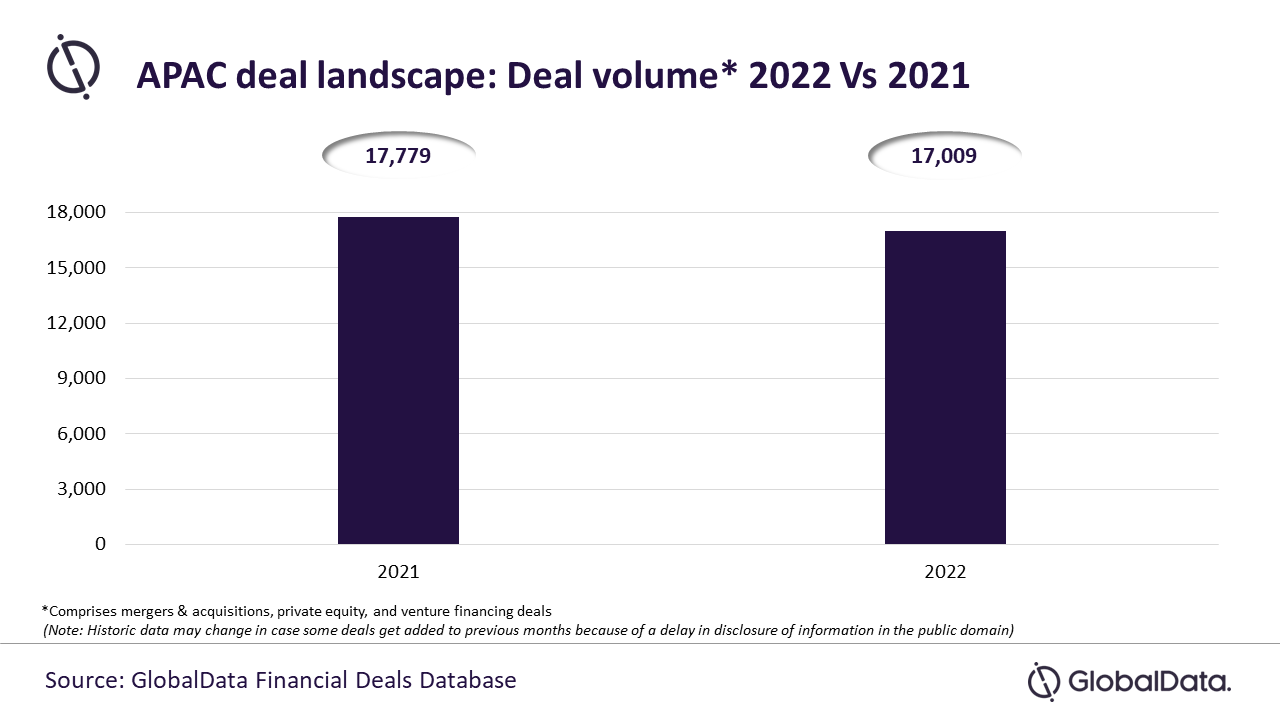

The Asia-Pacific (APAC) region has suffered a 4.3% decline in deal* activity during 2022. The decline is primarily driven by a significant 16.5% fall in deal activity in China, which accounts for around one-third of the region’s deals volume, reveals GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that a total of 17,009 deals were announced in APAC during 2022, compared to the 17,779 deals announced during the previous year.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Over the past couple of years, China’s regulatory crackdown on its tech companies, coupled with stringent zero-COVID policy has affected investor confidence. Subsequently, the country experienced a year-on-year drop in deal volume. Several other key markets of the region also registered a decline during 2022.”

The number of venture financing deals, private equity deals and merger & acquisitions deals announcements year-on-year declined by 3.5%, 19.1% and 3.6%, respectively, in 2022.

Bose continues: “Although there is a decline in the overall regional deal activity, it is still in a relatively better position when compared to the global deal activity, which was down by 9.9%. The positive trend experienced in some of the markets was able to minimize the impact of decline registered in China and some of the other key markets.”

Australia, Singapore, Hong Kong, Malaysia and New Zealand witnessed decline in deal volume by 8%, 0.9%, 21.9%, 10.9% and 12.6% in 2022 compared to 2021, respectively. Meanwhile, India, Japan, South Korea and Indonesia experienced increase in year-on-year deal volume by 6.8%, 13.7%, 3.1% and 14.6%, respectively.

Bose concludes: “Although many key APAC economies have reported a slowdown in deal activity, the positive trend experienced in India, Japan and some other countries could also be seen as a bright spot for deals activity in the region.”