Don’t miss more than half the world’s consumption story over the next decade: Asia

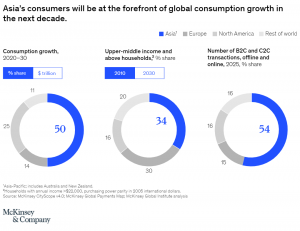

Asian consumers are expected to account for half of global consumption growth in the next decade, offering a $10 trillion consumption growth opportunity.

Globally, one of every two upper-middle-income and above households is expected to be in Asia, and one of every two transactions to be made by consumers in the region. Strong prospects for consumption in the region reflect falling rates of poverty and rising incomes and spending power. Capturing this growth will require understanding the region’s diversity and rapidly changing consumer behaviors. Companies will need to acquaint themselves with Japanese Insta-grannies, Indonesian Generation Z gamers, Indian small shop owners, Chinese lifestyle-indulging millennials, and others.

Globally, one of every two upper-middle-income and above households is expected to be in Asia, and one of every two transactions to be made by consumers in the region. Strong prospects for consumption in the region reflect falling rates of poverty and rising incomes and spending power. Capturing this growth will require understanding the region’s diversity and rapidly changing consumer behaviors. Companies will need to acquaint themselves with Japanese Insta-grannies, Indonesian Generation Z gamers, Indian small shop owners, Chinese lifestyle-indulging millennials, and others.

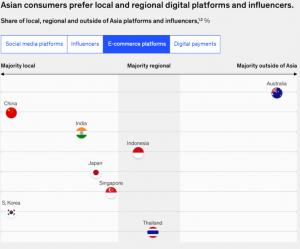

Consumers in Asia opt for Asian platforms and influencers

Asian consumers are increasingly online and mobile first across age groups, from members of Generation Z voraciously consuming video content to the more than 90 percent of seniors in Japan and South Korea expected to be online by 2030.

But what platforms, influencers, and payment methods do Asian consumers prefer? Asian platforms are gaining prominence and crossing borders. However, there is still no single playbook in the region, and companies will need to adjust their digital footprint to local markets. Asia’s digital generation tends to use non-Asian social-media platforms, but largely follow local social-media influencers. They use Asian e-commerce platforms and local digital payments providers. Within this broad picture, however, there are significant variations. Chinese consumers largely adopt local platforms, while Australian consumers tend to use non-Asian ones.

But what platforms, influencers, and payment methods do Asian consumers prefer? Asian platforms are gaining prominence and crossing borders. However, there is still no single playbook in the region, and companies will need to adjust their digital footprint to local markets. Asia’s digital generation tends to use non-Asian social-media platforms, but largely follow local social-media influencers. They use Asian e-commerce platforms and local digital payments providers. Within this broad picture, however, there are significant variations. Chinese consumers largely adopt local platforms, while Australian consumers tend to use non-Asian ones.